Ford Stock Predictions 2025 – Investing in the automotive industry has always been an exciting and challenging endeavor. With rapid advancements in technology, shifting consumer preferences, and a rapidly growing electric vehicle (EV) market, it’s crucial for investors to stay informed about key players in the industry. In this article, we will dive into Ford stock predictions for 2025 and analyze the factors that could drive its performance.

Key Factors Driving Ford’s Stock Performance

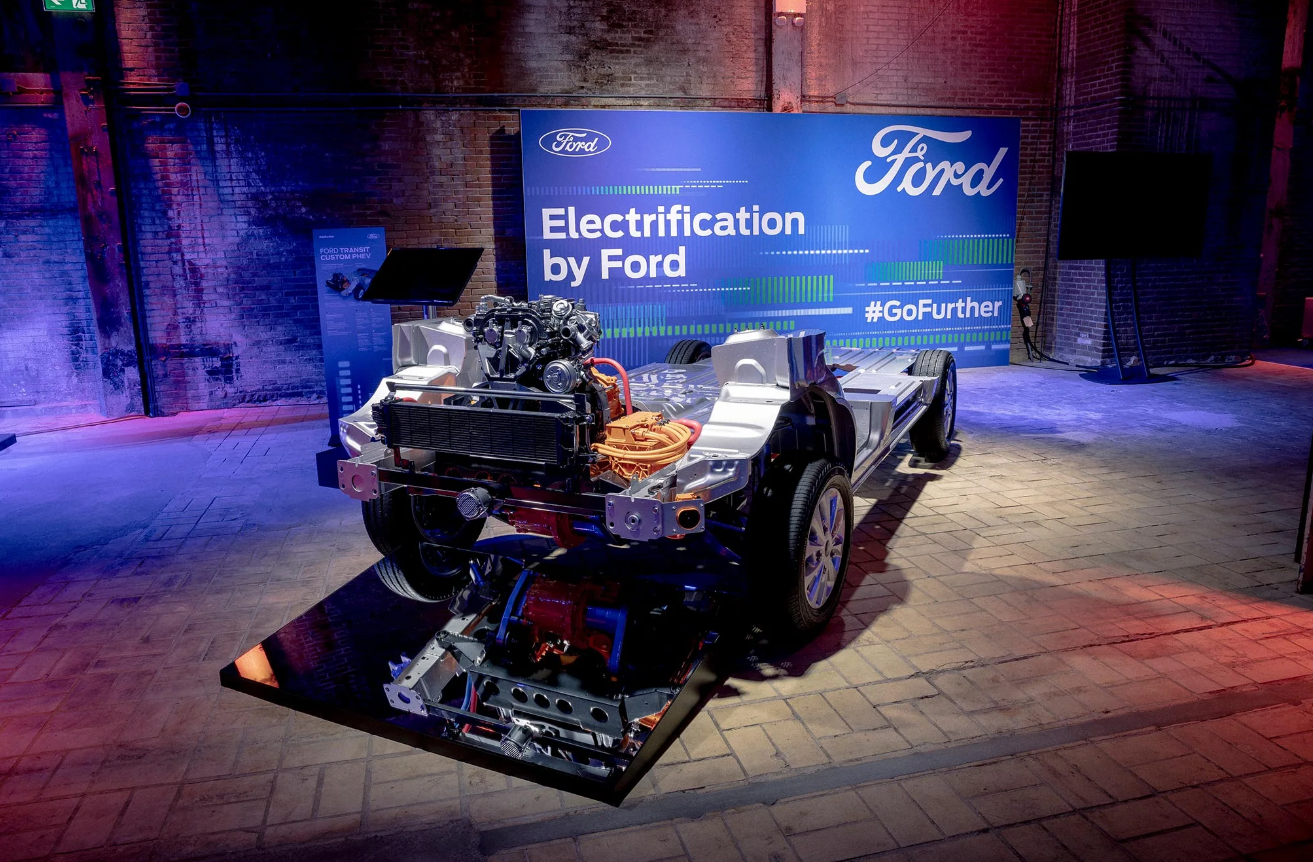

Electrification and Electric Vehicle (EV) Market

As the world moves towards sustainability and clean energy, the demand for electric vehicles is expected to soar. Governments across the globe are setting ambitious goals to reduce greenhouse gas emissions, which will significantly benefit companies like Ford that are investing heavily in electrification.

Global Economic Outlook

The overall health of the global economy plays a crucial role in determining the performance of auto stocks. Economic growth leads to higher consumer spending and increased demand for vehicles. Ford’s stock performance will likely be influenced by the state of the global economy in 2025.

Competition and Market Share

With several new entrants in the EV market and traditional automakers ramping up their electric offerings, competition for market share is fierce. Ford’s ability to maintain and expand its market share will be a critical factor in determining its stock performance in 2025.

Government Policies and Regulations

Government policies and regulations, such as tax incentives and subsidies for EVs, can significantly impact the growth of the industry. Changes in policies could either fuel or hinder Ford’s stock performance in the coming years.

A Closer Look at Ford’s Strategy

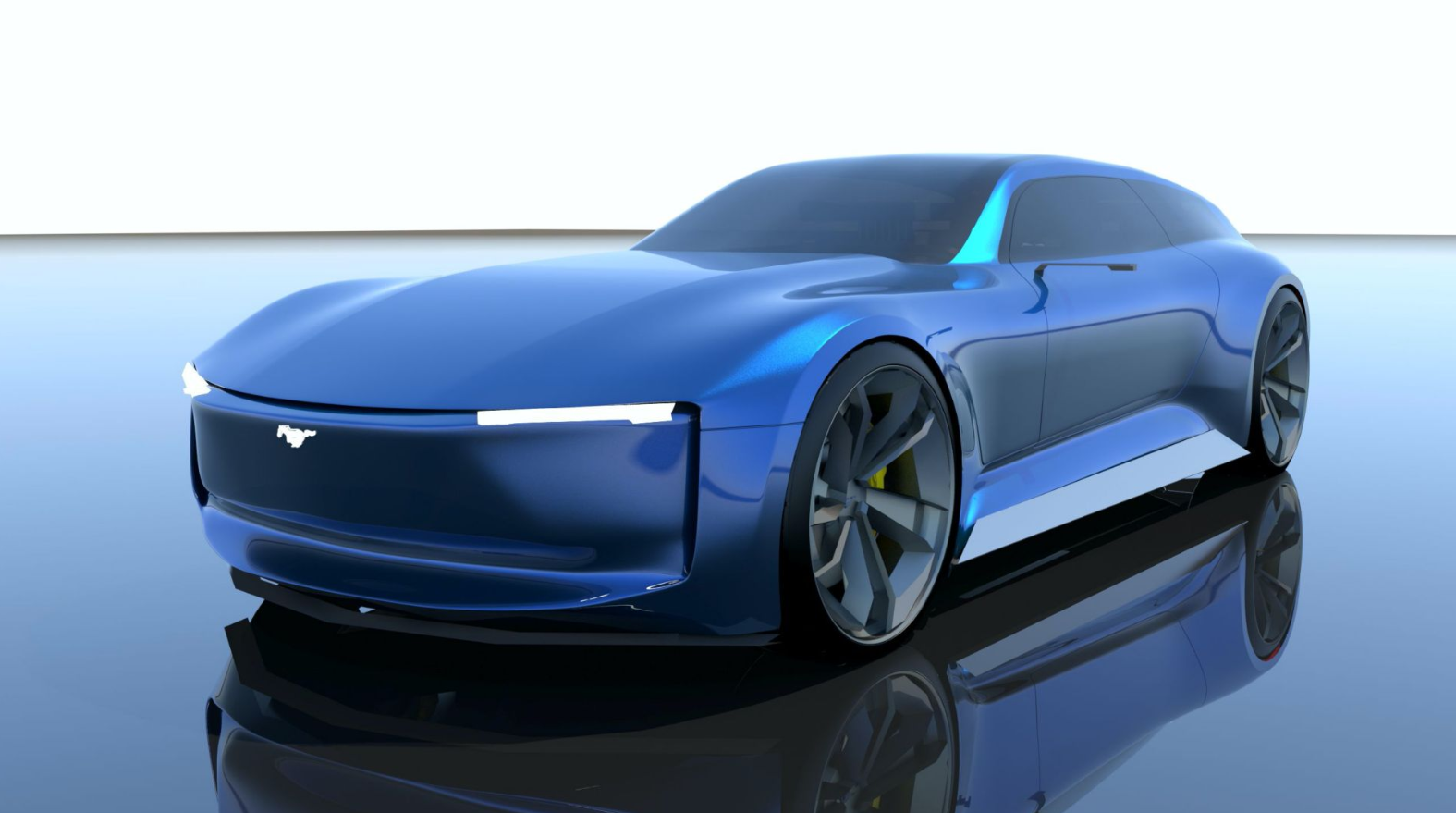

EV Lineup Expansion

Ford has ambitious plans to expand its electric vehicle lineup, which includes the highly anticipated F-150 Lightning and the Mustang Mach-E. Success in launching and selling these new models will be crucial to Ford’s growth and stock performance.

Technological Advancements and Autonomy

Investments in autonomous vehicle technology and connectivity features are expected to boost Ford’s competitiveness in the market. The company’s ability to innovate and stay ahead of the curve will play a significant role in its stock performance.

Strategic Partnerships and Collaborations

Ford has established strategic partnerships with various companies, such as Rivian and SK Innovation, to strengthen its position in the EV market. These collaborations could provide a competitive edge and contribute to the company’s stock performance in 2025.

Analysts’ Predictions for Ford Stock in 2025

Predicting the exact stock price for any company is challenging due to various factors, including market volatility and unforeseen events. However, many analysts remain optimistic about Ford’s growth prospects, especially with the company’s commitment to electrification and new product launches. It’s essential to research and consider multiple expert opinions before making an investment decision.

Risks and Challenges

Supply Chain Disruptions

The global automotive industry has faced supply chain disruptions, including the ongoing semiconductor chip shortage. These challenges could impact Ford’s production capabilities, resulting in potential delays or reduced output, which could negatively affect the stock price.

Intense Competition

With numerous players in the EV market and traditional automakers investing heavily in electric technology, Ford will face increased competition. This intense rivalry may put pressure on the company’s market share and, consequently, its stock performance.

Economic Downturns

Economic downturns, recessions, or any significant financial crisis can negatively affect consumer spending, leading to decreased demand for vehicles. Ford’s stock performance may suffer during such times, which investors should consider when making long-term investment decisions.

Alternatives to Ford Stock Investment

Investors looking for exposure to the automotive and EV sectors may consider other companies or exchange-traded funds (ETFs) focusing on electric vehicles, autonomous driving technology, or clean energy. Some examples include Tesla, General Motors, NIO, or ETFs like the Global X Autonomous & Electric Vehicles ETF (DRIV).

Conclusion

While predicting the exact stock price of Ford in 2025 is challenging, the company’s commitment to electrification, strategic partnerships, and technological advancements could positively impact its performance. However, investors should be aware of the risks and challenges associated with investing in the automotive industry and consider multiple factors before making a decision.

Frequently Asked Questions

- Q: What are the key factors that could impact Ford’s stock performance in 2025?

- A: Key factors include electrification and the EV market, global economic outlook, competition and market share, and government policies and regulations.

- Q: How is Ford planning to expand its electric vehicle lineup?

- A: Ford plans to expand its electric vehicle lineup with models like the F-150 Lightning and the Mustang Mach-E.

- Q: What are some of the risks and challenges Ford may face in the coming years?

- A: Risks and challenges include supply chain disruptions, intense competition, and economic downturns.

- Q: Are there any alternatives to investing in Ford stock?

- A: Investors can consider other automotive companies, such as Tesla, General Motors, or NIO, or invest in ETFs that focus on electric vehicles and clean energy, like the Global X Autonomous & Electric Vehicles ETF (DRIV).

- Q: How important are strategic partnerships and collaborations for Ford’s growth?

- A: Strategic partnerships and collaborations, such as those with Rivian and SK Innovation, can strengthen Ford’s position in the EV market and provide a competitive edge.